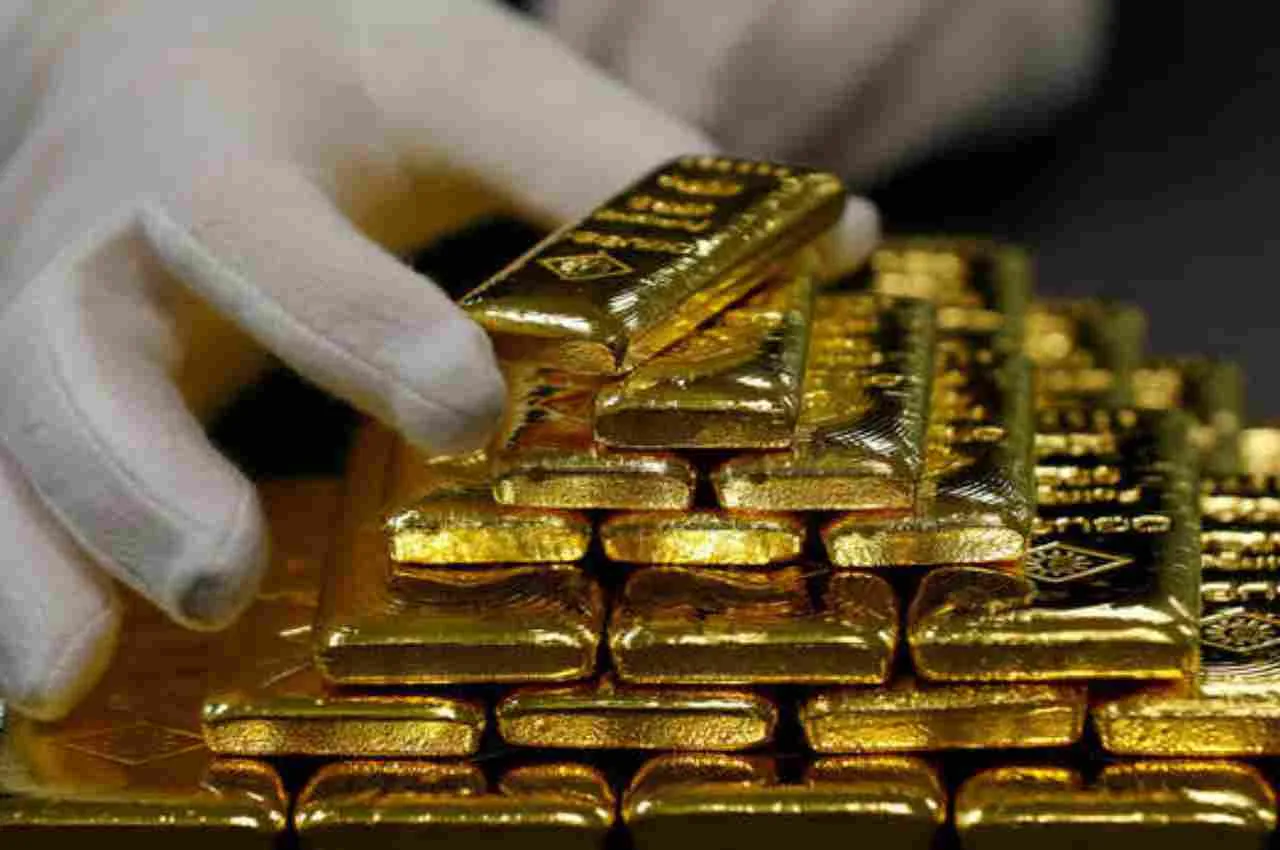

Gold Investing: The National Stock Exchange (NSE) commodity market is about to change its landscape. Until now, gold futures were considered the domain of large traders only. However, with SEBI’s approval, the market is now fully open to the public. Starting March 16th, a new beginning is being made in the commodity derivatives segment. NSE is launching its “Gold 10 Gram Futures” contract. This will allow even small investors to directly benefit from fluctuations in gold prices, enabling them to trade easily with minimal capital.

This contract will be available in monthly series

This new NSE contract will be available in monthly series. Its trading symbol is ‘GOLD10G’. The contract expires on the last calendar day of each month. If that day falls on a public holiday, the preceding working day will be considered as the expiration date. Investors will be able to trade from 9:00 AM to 11:30 PM, Monday through Friday. During US daylight saving time, trading hours may be extended to 11:55 PM. A maximum of 10 kg of gold can be traded in a single order under this contract.

Understand the delivery rules as well

Delivery will be mandatory under this contract. Customers will receive 10 grams of 999 purity gold, along with a quality certificate. Delivery will be made at the Ahmedabad center through a supplier approved by the NSE or LBMA. The contract price will be based on the Ahmedabad rate, which includes customs duty, but GST will be payable separately.

This is NSE’s plan for risk management

To mitigate market risk, NSE has set a daily price limit of 6 percent. In case of significant price movements, this limit can be increased to 9 percent after a 15-minute cooling-off period. The maximum position limit for any individual investor is 5 metric tons. Final settlement will be based on the Ahmedabad spot gold price.