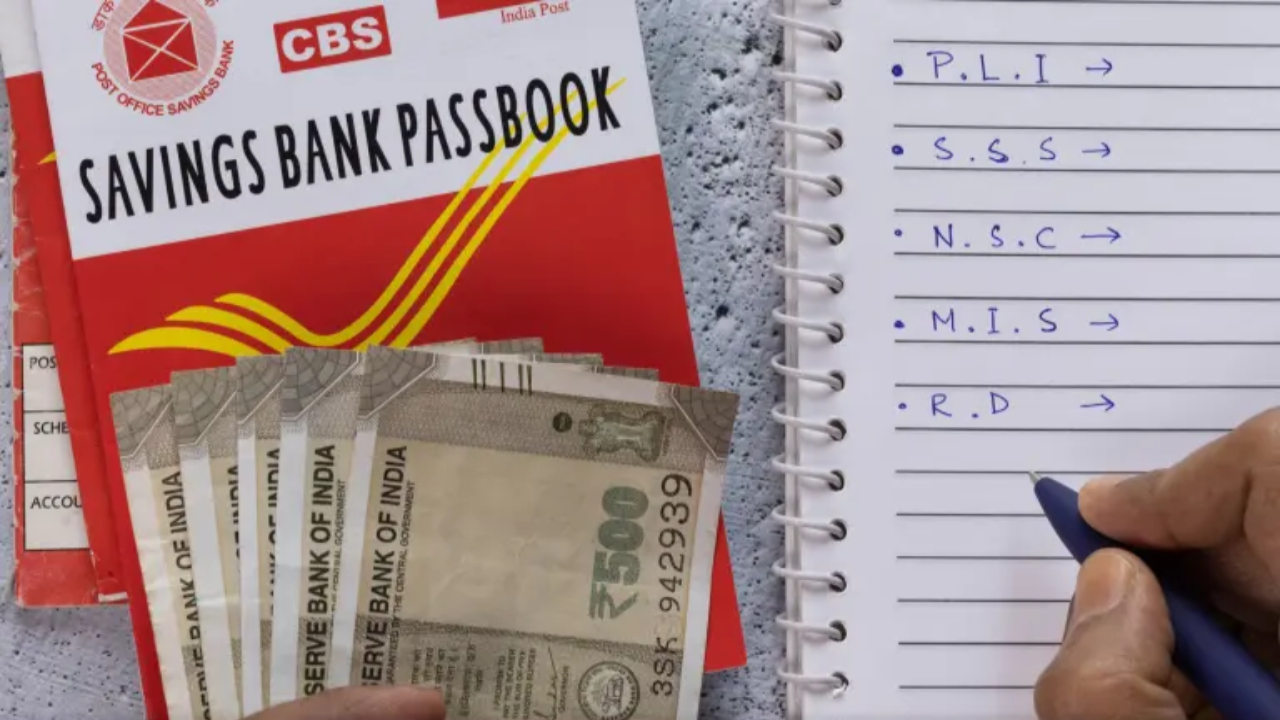

Nowadays, everyone is looking for ways to increase their money in a safe way. There is a risk of fluctuations in the stock market or other investment schemes, but the Post Office Recurring Deposit (RD) scheme is a better option for those who want to make a large amount by investing a little every month. This scheme comes with complete government security, in which a fixed interest rate and guaranteed return are available.

Read Here- Buy The Redmi 13C at just ₹ 8,999 With upto 1TB expaned storage

How does the Post Office RD scheme work

Investors can start with a minimum of Rs 100 in the Post Office RD scheme. The duration of this scheme is 5 years, i.e., 60 months. Currently, a 6.7 percent annual interest rate has been fixed on it. The investor has to deposit a fixed amount every month, and on maturity, the entire amount is returned with interest.

The benefit of investing Rs 1000 per month

If a person invests Rs 1000 every month in this scheme, then a total of Rs 60,000 will be deposited in 5 years, i.e., 60 months. On maturity, he will get Rs 70,989 back. In this, about Rs 10,989 will be in the form of interest.

The benefit of investing Rs 2000 per month

Investors who deposit Rs 2000 every month will deposit Rs 1,20,000 in 5 years. On maturity, they will get Rs 1,42,732, out of which Rs 22,732 will be only in the form of interest.

The benefit of investing Rs 3000 per month

If you save Rs 3000 every month, then a total of Rs 1,80,000 will be deposited in a period of 5 years. On maturity, this amount will increase to Rs 2,14,097. In this, Rs 34,097 will be only interest.

Read Here- Mahindra XUV300 vs Hyundai Venue : Which Compact SUV is Better for Indian Buyers?

Safe and reliable scheme

The RD scheme of the post office is considered special because it is completely safe and government guaranteed. It does not fluctuate like the market, and you know in advance how much money you will get on maturity. For this reason, it remains a favorite scheme of small investors and those who want safe returns.