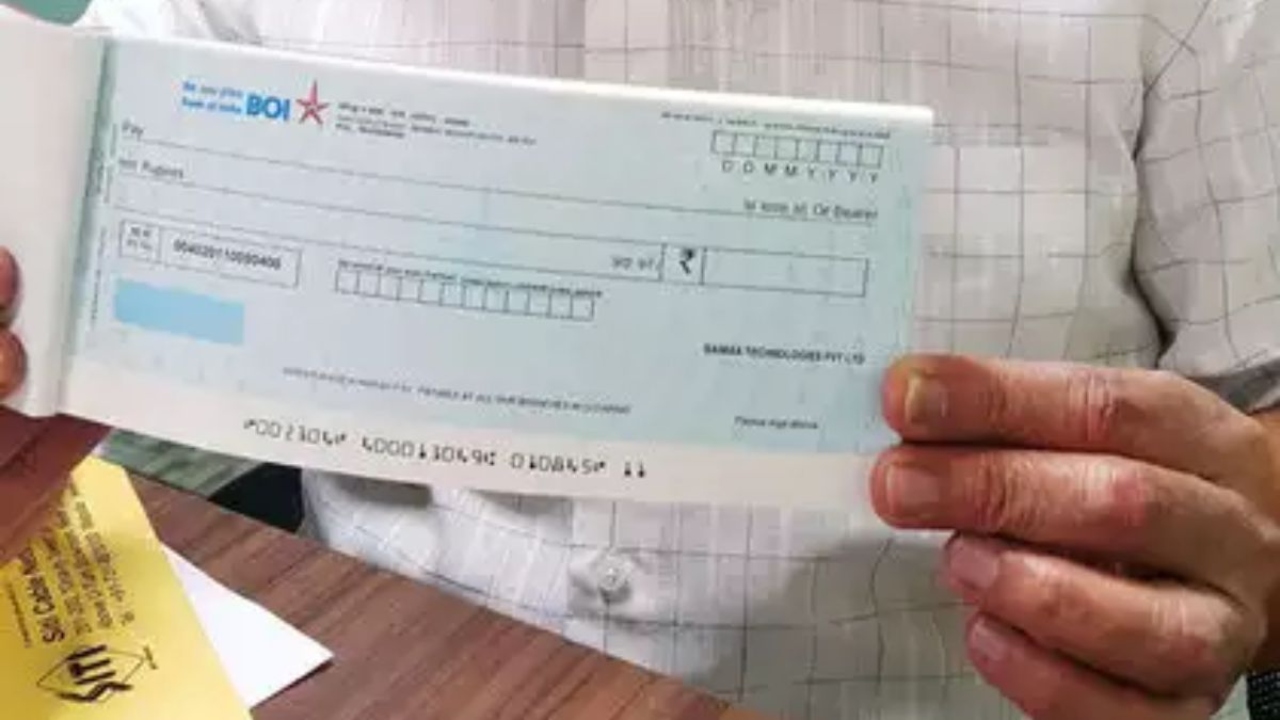

Cheque Clearance Rules: RBI, the country’s largest bank, has taken a big decision. This change is related to the check. Let us tell you that after this change, from October 4, 2025, the time for check clearance will be reduced considerably. Till now, it takes 2 to 3 days for the check to be cleared. But after the implementation of this new system, the work will become easy in a few hours. Let us tell you that from October 4, the old problem of check clearance will be over to a great extent. Now you will not have to wait for days for the check to clear.

Know about the new system

For information, let us tell you that till now, the check clearing bench used to run the processing system, which means that the banks send the check at a fixed time, and then process it and clear it. But after the decision of the RBI, this system has been changed. After the implementation of this system, the checks will be cleared throughout the day.

Read Here: Authentic Bihari Aloo Kachalu Recipe – Simple Method to Try at Home

How will the process be done?

Let us tell you that the banks will continuously scan the checks from 10 am to 4 pm and send them to the clearing house.

The clearing house will immediately send the image of the check to the bank on which the check has been issued.

The bank will have to tell on the same day at the stipulated time whether the check will be passed or bounced.

For information, let us tell you that from October 4, the bank will have to give confirmation by 7 pm. If the bank does not respond, the check will be considered automatically passed. At the same time, from January 3, 2026, the confirmation time will be reduced to 3 hours. After this, the check will be confirmed by 2 pm.

How will the customers get the benefit?

Let us tell you that now the money will come to the customers’ accounts faster. In this, as soon as the check is passed, the bank will have to give money to the customers within one hour. This will provide relief to traders, employees, and general customers. In this, the objective of the RBI is to make the transaction fast and easy. The delay in settlement is to be eliminated. At the same time, the experience of the customers is to be improved.

Along with this, the RBI has also allowed that the balance kept in foreign currency can be invested in government bonds. This will increase liquidity in the market. With the new system, both the customer and the bank will get the benefit of time and service.