EPF Advance or Personal Loan: Imagine your pocket is empty. There is a pile of bills on your head, or a big expense is looming ahead. In such a situation, only one question comes to mind – “Should I withdraw money from my EPF deposit (Employees’ Provident Fund) or take a personal loan from the bank?” In such a situation, withdrawing money from the PF may seem easier at first glance. But which of the two is better, so that you can make the right decision? You will get all this information in this article. Your EPF is a reliable piggy bank made for your retirement.

Every month, you and your company together deposit 12-12% of your basic salary and dearness allowance into it. This money is the support of your old age, but EPFO also allows you to break this piggy bank before time for some special needs – this is called EPF advance. On the other hand, a personal loan is immediate money taken from the bank, but it comes with the burden of interest and EMI. Let us understand the advantages and disadvantages of both these options in five simple points.

Terms and ease of getting money

Personal loan:- Getting a loan from a bank has become very easy today – you just need to have a good credit score and a stable source of income. Whether you need money for marriage, buying a car, or travelling, there is no restriction on spending! You can use it for any of your personal needs. Banks easily give loans after looking at your financial stability.

EPF advance:- This is not so easy. You can withdraw money from EPF only on certain occasions, such as studies, marriage, medical emergency, buying a house, or repaying old loans. You will not get this money without a solid reason! EPFO has made strict rules for this so that your retirement fund is not misused.

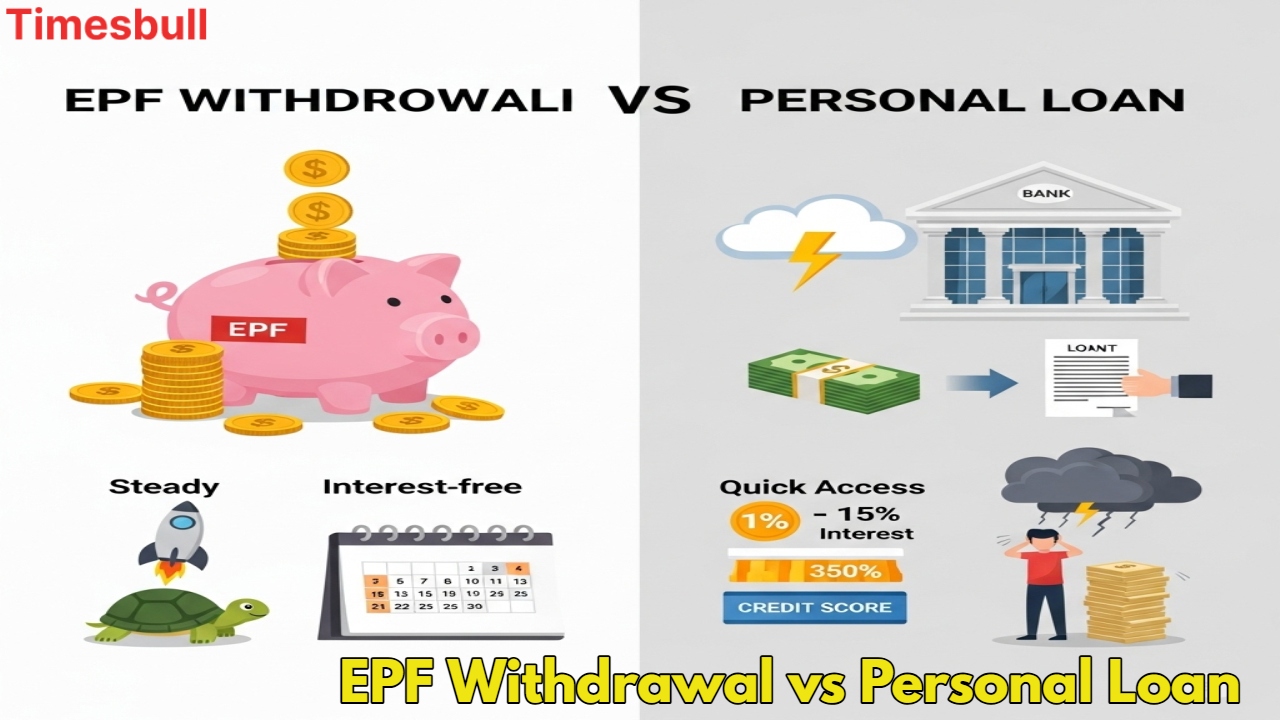

Interest burden

Personal loan:- You may have to pay interest ranging from 10% to 24% on this. If you have a great credit score, the interest may be slightly less, but the interest burden will still be there. This significantly increases your total repayment amount.

EPF Advance:- It is your own money, which you get back without any interest. Zero tension. It comes out of your account, and you do not have to pay any additional charges. This is its biggest advantage.

Who is available fast

Personal loan:- Usually, the money is in your account within 2-7 days. Sometimes you may have to wait a little more, especially if there is a delay in processing the documents. It has become much faster due to the digital process.

EPF Advance:- It depends on the reason for which you are withdrawing money. Approval may take 1-2 weeks. You have to have some patience! EPFO has to review your application and ensure that you meet the prescribed conditions.

Who is safe for your financial history

Personal loan:- If you pay EMIs on time, your credit score shines. It strengthens your financial record and helps in getting other loans or credit cards in the future. But if you miss even a single EMI, your score can be badly affected. This can be a big risk for your future.

EPF advance:- This is not a loan; it is your savings. So it does not affect your credit score. Tension free! You can withdraw money for your needs without any worry, and it will not have any negative impact on your financial record.

The hassle of repayment

Personal loan:- EMI has to be paid every month. If there is a delay, there is a penalty, and the credit score also gets dented. This is a regular financial commitment that you have to fulfill on time.

EPF advance:- No tension of repayment. This money is deducted from your EPF account itself. Your retirement fund will just get reduced a little. You don’t have to return it to any bank or institution.

When to take a personal loan

You should take a personal loan when:

You don’t want to break your retirement piggy bank.

You need money immediately for urgent work.

You are ready to pay interest and EMIs.

You need money immediately, and you can’t wait.

You have a good credit score, which can get you a loan at a low interest rate.

When to take EPF advance

You should take an EPF advance when:

You meet the criteria prescribed by EPFO.

You don’t want to be burdened with debt.

You don’t want to pay interest.

You don’t want your credit score to be affected.

You still have a lot of time left for your retirement, and the amount withdrawn will not have a huge impact on your future savings.

Your need is not urgent, and you can wait for 1-2 weeks.