Almost everyone dreams of owning a car, but buying one is a big expense for common people. It takes lakhs of rupees to buy a car. In such cases, many people take a car loan from the bank to make their dream come true. Different banks offer car loans at different interest rates. So, if you are planning to buy a car on loan, you should choose a bank that offers a lower interest rate than others. To take a car loan, you can choose the country’s largest government bank, the State Bank of India (SBI). SBI offers car loans to its customers at very affordable interest rates.

SBI Car Loan

The interest rates for SBI car loans start at 9.10%. This rate may increase depending on your eligibility and CIBIL score.

Monthly EMI for a ₹7 Lakh Car Loan from SBI

If you take a ₹7 lakh car loan from SBI for 5 years at an interest rate of 7.10%, your monthly EMI will be ₹14,565. Over 5 years, you will pay a total of ₹8,73,891 to the bank. This means you will pay ₹1,73,891 as interest alone.

How to Take a Car Loan from SBI

- Check Eligibility: Age 21-65, good income, and CIBIL score.

- Prepare Documents: ID proof, address proof, income proof, car quotation.

- Apply: Online via SBI’s website or visit a branch.

- Loan Approval: Once approved, the loan is disbursed to the car dealer.

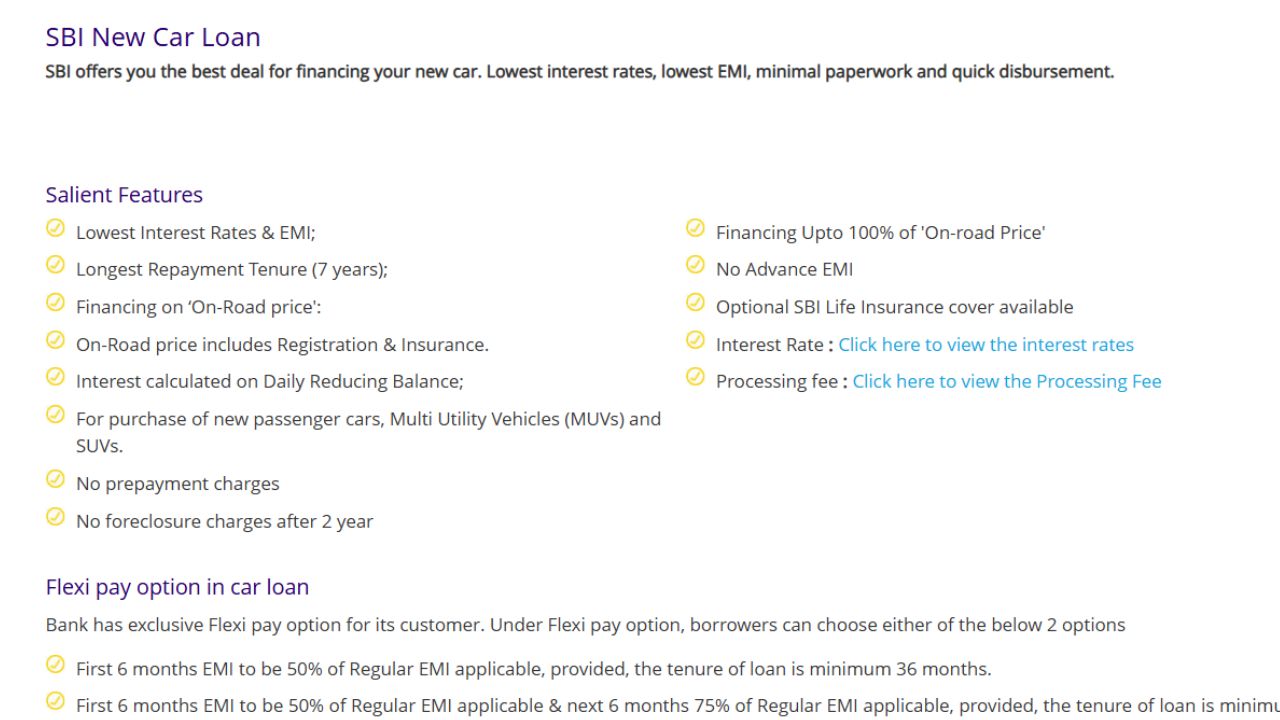

Salient Features of SBI Car Loan

-

Low interest rates and affordable EMIs

-

Long repayment tenure of up to 7 years

-

Loan available on the on-road price of the car

(On-road price includes registration and insurance) -

Interest is calculated on a daily reducing balance

-

Loan available for new passenger cars, MUVs, and SUVs

-

No prepayment charges

-

No foreclosure charges after 2 years

Disclaimer: The interest rates and EMIS are subject to change based on eligibility and the bank’s terms. Loan approval depends on the applicant’s creditworthiness and other criteria. Please visit the nearest SBI branch or official website for detailed terms and conditions. Timesbull will not be responsible for any transactions.