Most people dream of building a large bank balance after starting their career. For middle-class Indians, building a corpus of Rs 25 lakh is a major financial milestone. Although this goal may seem daunting at first glance, it is entirely possible to achieve it with proper planning and patience. It is difficult to achieve this goal by simply keeping money in the bank; smart investment is required for this.

A detailed outline of how to achieve this goal step by step through a Systematic Investment Plan (SIP) in Mutual Funds is discussed below.

The magic of compound interest and long-term planning

The key to wealth creation is not just earning more, but also putting your hard-earned money to good use. Time or tenor is a big tool for salaried employees. The longer you invest, the more you will get the benefits of compounding. Long-term SIPs in equity mutual funds are currently one of the best ways to increase the real value of money by beating inflation, where an average annual return of 10-12 percent can be expected.

The amount of monthly investment depends on how much time you have. The less time, the greater the pressure of monthly installments. On the other hand, if the time is more, it is possible to build a large capital even with a small amount of money.

Mathematical calculation of depositing 25 lakh

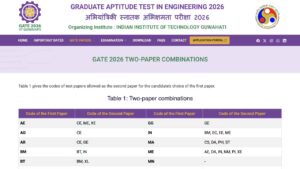

Assuming an estimated annual return of 12 percent, here is an estimate of how much money you will need to invest per month to deposit 25 lakh taka over different time periods:

| Tenure | Monthly SIP (Rs) | Total Original Deposit | Estimated Profit | Total Maturity Value |

|---|---|---|---|---|

| 5 years | 31,000 | 18.6 lakh | 6.54 lakh | 25.14 lakh |

| 10 years | 11,500 | 13.8 lakh | 11.96 lakh | 25.76 lakh |

| 15 years | 5,500 | 9.9 lakh | 16.28 lakh | 26.18 lakh |

It is clear from the above table that a huge difference can be made in the amount of monthly investment in just a few years. Those who start 15 years ago can reach the goal by saving just Rs 5,500 per month. But if you have only 5 years left, that figure increases to Rs 31,000, which is not possible for many.

Strategies for salaried employees

As soon as you get your salary, you should set aside a certain amount for investment. Those who are starting a new job can start with Rs. 5,000 per month. However, currently, investing Rs. 8,000 to Rs. 15,000 per month to reach your target of 10-15 years by 2026 is a realistic and ideal step. Job Opportunities

Tips: Increase your SIP amount slightly every year with increments or bonus money. While it may seem small at the beginning, these small increases make a big difference in the long run. Consistency is the key to success here.

Disclaimer: This article is for informational purposes only. It is not financial advice. Mutual fund investments are subject to market risks. Before investing, you must consult a registered financial advisor and read the scheme documents carefully.