Lenskart Stock Update: Lenskart Solutions Limited is a well-known brand within the eyewear sector; its initial public offering (IPO) is going to be open for subscription this week; the company is expected to be a major contender amongst the best-performing IPOs of 2023. Lenskart Solutions Limited is led by its Co-Founder and CEO, Piyush Bansal, who has brought together some of the leading investment firms globally. The following sections will provide further details related to this IPO. They will include key highlights such as opening date, price band, general movements in price (GMP), and listing date.

When will Lenskart IPO open and close

The Lenskart IPO was open for subscription on Friday, October 31, 2025. The company is expected to finalise the allotment of shares by November 6. The shares are likely to be listed on both the BSE and NSE on November 10, 2025.

Lenskart IPO price band

The company has set a price band of Rs 382-402 per share for its IPO. At the upper end of the price band, Lenskart is seeking a valuation of around $7.91 billion (around Rs 72,700 crore).

The issue includes a fresh share issue of Rs 2,150 crore, where promoters and investors will issue over 127.5 crore equity shares in the offer-for-sale (OFS) segment.

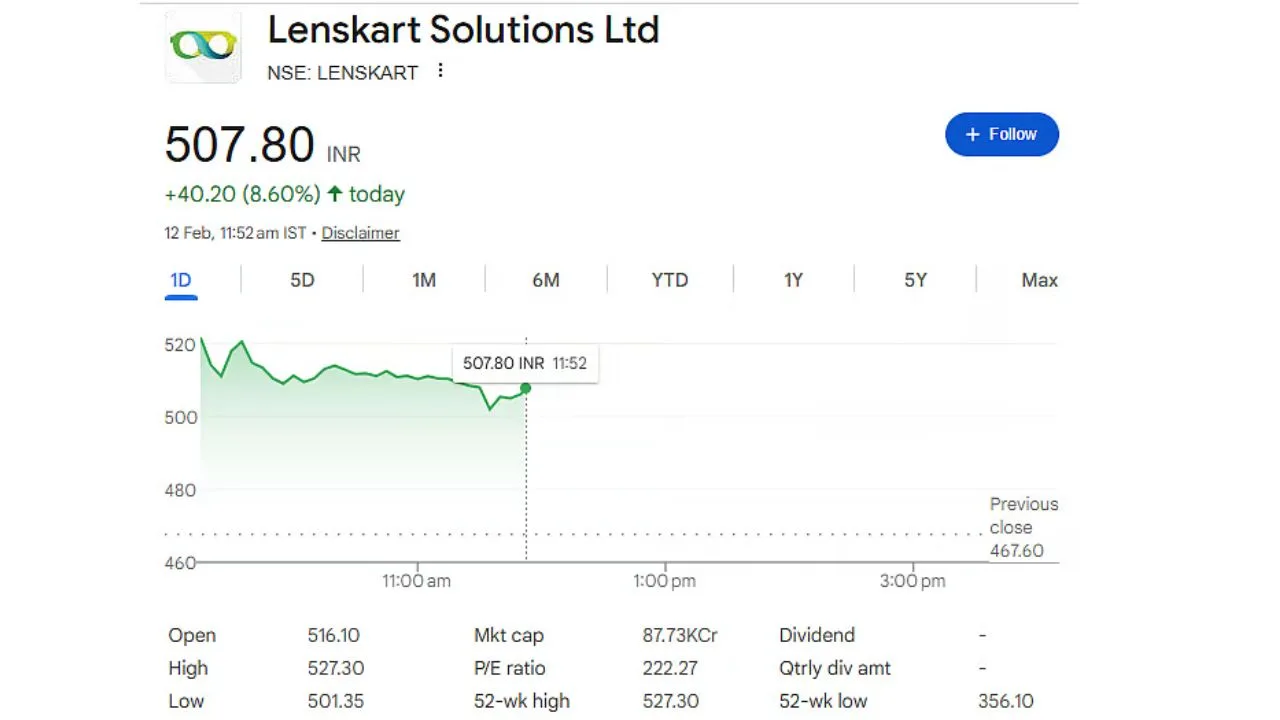

Shares of eyewear company Lenskart jumped more than 12 percent to a record high of Rs 526 on February 12 after the company announced strong Q3 FY26 results. The sharp rise came as investors reacted positively to strong profit growth, higher margins and strong demand in both India and international markets.

#MCPro | For Lenskart, growth and margins are compounding together, but at current valuations, execution must stay flawless.

Get more updates here 👇https://t.co/gXYGwK1XG4 pic.twitter.com/zsYMOFI3CQ

— Moneycontrol (@moneycontrolcom) February 12, 2026

Profit Jumps Sharply Year-on-Year

Lenskart reported consolidated net profit of about Rs 133 crore in Q3 FY26. This was a massive jump compared to only Rs 1.8 crore profit in the same quarter last year.

The company said profit growth was supported by better product margins, strong customer addition and improving performance in global markets. Domestic profit before tax rose more than three times to Rs 161 crore from Rs 48 crore last year.

Market Opportunity And Business Expansion Plans

Lenskart conducted over 60 lakh eye tests during the quarter, with many first-time users. The company estimates India’s eyewear market at Rs 79,000 crore, while total demand could be above Rs 4 lakh crore.

The company also announced new ESOP plans worth over Rs 1,500 crore combined to reward employees and support long-term growth.