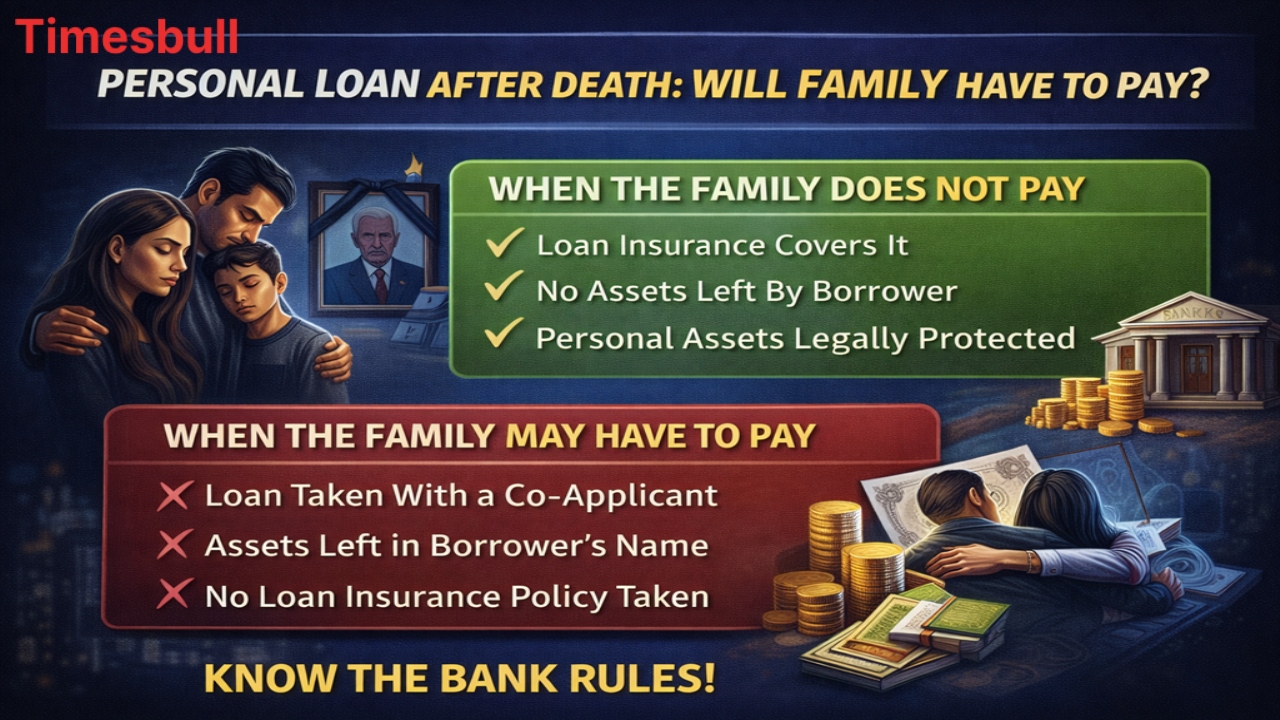

A personal loan is an unsecured loan, meaning the bank doesn’t have any gold or land as collateral. To mitigate this risk, most banks now recommend loan protection insurance when disbursing the loan. If the borrower has insured the loan, the bank directly contacts the insurance company in the event of the borrower’s death.

The insurance company pays the outstanding amount as per the policy terms, and the bank automatically closes the loan account. In this situation, the family is not burdened with even a single penny. Therefore, taking out insurance when taking a loan is considered a wise decision as it protects your loved ones from debt in times of crisis.

Loan Recovery and Bank Rights

If the loan is not insured, the bank turns to the deceased’s assets to recover its losses. The bank first examines the deceased’s investments, such as savings account balances, fixed deposits (FDs), shares, and mutual funds. The bank has the absolute right to recover its dues before handing over the property to the legal heirs.

If cash is short, the bank can also claim gold or other movable and immovable assets held in the deceased’s name. Even if the deceased had a life insurance policy, the bank can attempt to recover the claim amount from that policy. However, this is only possible if there is property in the deceased’s name.

Will the family have to pay out of their own pocket

This is the biggest and most crucial question, the answer to which will bring relief. Legally, in the case of a personal loan, the bank cannot force the deceased’s family members or heirs to repay the loan by selling their personal assets.

The bank can only recover the amount to the extent of the assets left behind by the deceased. If the deceased did not own any property and the loan was not insured, the bank must ultimately write off the loan. This represents a significant financial loss for the bank, but the family is not legally responsible for repaying the loan out of their own pocket.

Responsibility of the Co-Applicant

The rules change completely if the loan is taken jointly. If the loan includes a co-applicant (such as a spouse), the entire responsibility for repaying the loan falls on the co-applicant’s shoulders after the primary borrower’s death. In this case, the bank directly demands the outstanding amount from the co-applicant, and they are required to continue paying the EMIs. Being a co-applicant means that you are equally responsible for the loan’s smooth repayment.

What steps should the family take in such a situation

If such a tragic event occurs in the family, instead of panicking, follow the correct procedure. First, officially inform the bank and submit a copy of the death certificate. This will enable the bank to initiate a robust recovery process and prevent unnecessary penalties. Next, immediately check whether the loan was covered by a ‘Credit Shield’ or insurance. If bank employees pressure the family to make payments privately, seek legal advice immediately, as you are not responsible for the deceased’s personal unsecured loan.