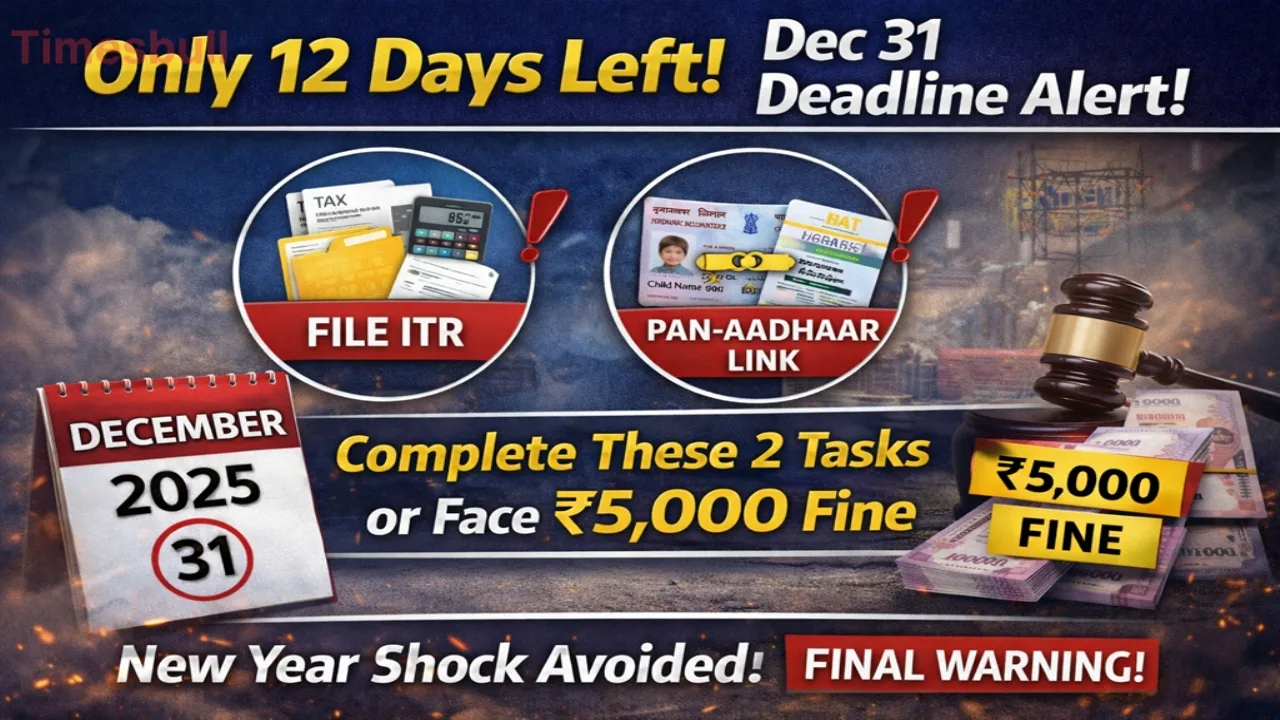

The year 2025 is now in its final stages, and with December 19th having passed today, you have only 12 days left. If you think there’s still plenty of time to celebrate the New Year, be sure to check your financial diary. The deadlines for important tasks like filing your Income Tax Return (ITR) and PAN-Aadhaar linking expire on December 31, 2025. Missing these deadlines could be costly, as you’ll not only face hefty fines but your banking transactions could also be halted. In this article, we’ll explain in detail the two crucial tasks you should complete immediately without delay.

Last chance to avoid a ₹5,000 fine

If you forgot to file your income tax return on time for the financial year 2024-25 (assessment year 2025-26), don’t panic. The government is giving you one last opportunity to file a belated return until December 31, 2025. After that, you will not be able to file this year’s return at any cost.

Filing your return late will incur a late fee. According to Income Tax Department rules, if your total annual income is less than ₹5 lakh, you will have to pay a penalty of ₹1,000. However, if your income is ₹5 lakh or more, the penalty will increase to ₹5,000.

Serious Disadvantages of Not Filing Your ITR on Time

The ITR is not only a means of filing taxes, but also a testament to your financial health. Not filing it on time can cause you harm on many levels. First, if you have any tax refunds due, they may be stuck or severely delayed. Furthermore, under Section 234A, you will have to pay additional interest every month on the outstanding tax, increasing your overall financial burden.

Not filing your ITR also impacts your future planning. Banks often ask for ITRs for the last three years when granting home or car loans. Failure to file returns on time weakens your credit profile and loan eligibility. Furthermore, the Income Tax Department keeps a close watch on those who consistently fail to file their returns, significantly increasing the likelihood of future investigations or notices.

2. PAN-Aadhaar Linking

The second most important task is for those who obtained their Aadhaar card on or before October 1, 2024, and have not yet linked it to their PAN. December 31, 2025, is the deadline. If you fail to complete the linking within this deadline, your PAN card will become inoperative.

Once your PAN card is deactivated, you will be barred from conducting banking transactions exceeding ₹50,000, and your investments in the stock market or mutual funds will be completely halted. Additionally, your TDS will be deducted at a much higher rate than normal. This linking is now mandatory not only for tax filing but also for banking security.

How to link PAN and Aadhaar in minutes

The process of linking PAN and Aadhaar is extremely simple and completely digital. You can complete it from the comfort of your home by visiting the Income Tax e-filing website. You will need to enter your PAN number and Aadhaar number, and verify it via an OTP received on your registered mobile number. You can complete this process instantly by paying the government-imposed penalty online. You can also complete this process via SMS, although using the website is considered more secure and accurate.