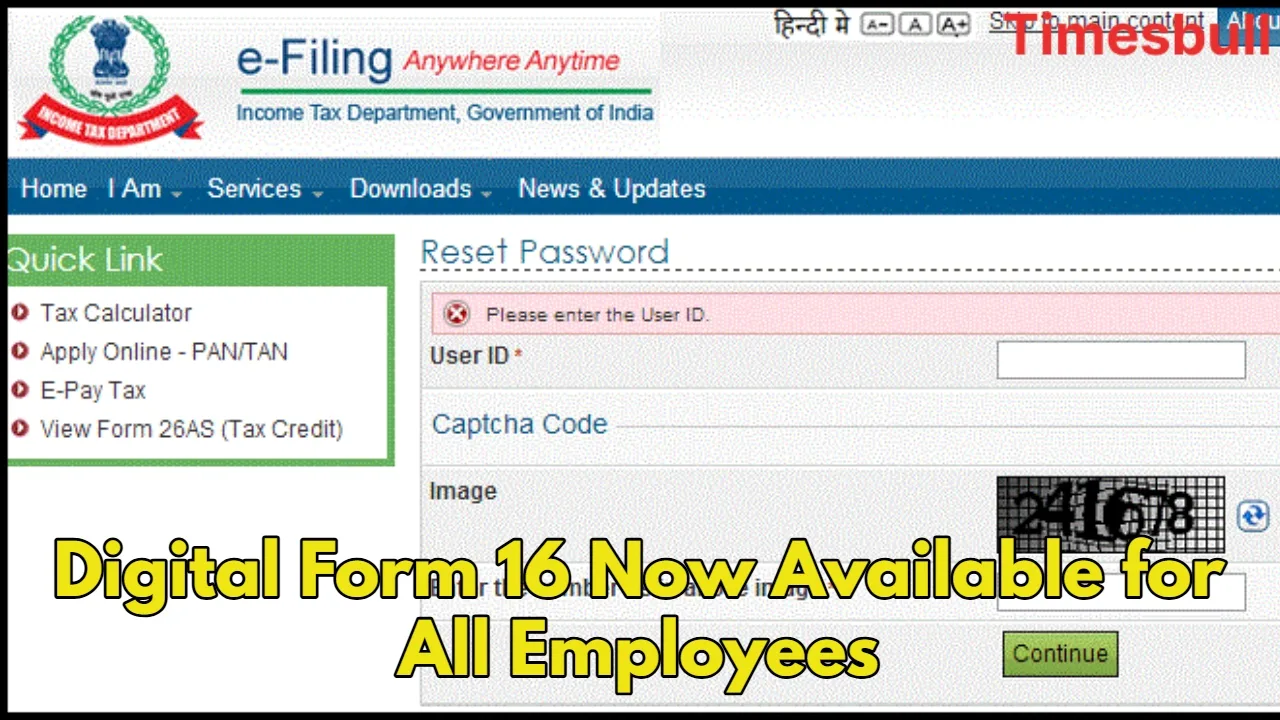

Digital Form 16: People doing jobs are eagerly waiting for the release of ‘Form 16’. Meanwhile, the Income Tax Department has extended the last date for filing returns. The Central Board of Direct Taxes (CBDT) informed about this on May 27. Now the last date for filing an income tax return (ITR) is September 15, 2025. Usually, the last date for filing an income tax return is July 31.

But this time many changes have been made in the ITR form. The Income Tax Department has not yet issued utilities for filing returns online. Therefore, the last date for filing returns has been extended. This is a big relief for millions of salaried taxpayers who often face last-minute rush.

What is Form 16 and why is it important

Form 16 is issued for filing Income Tax Returns (ITR) of salaried taxpayers. Form 16 contains complete information about the salary income of the employee. It contains information about the total amount of salary package paid by the company to the employees in the relevant financial year.

It also contains information about tax deducted from a source (TDS). The company transfers the salary to the employee’s salary account after deducting tax every month. The company deposits the TDS amount with the income tax department. The company starts deducting tax every month from the employee’s salary at the beginning of the financial year.

If the source of income of an employee is only salary, then he does not need to file an income tax return and pay more tax. The reason for this is that the company (employer) has already deducted tax from the salary of the employee.

The complete information on tax deducted in the entire financial year is in Form 16. Therefore, it is necessary to file an income tax return. If the taxpayer uses the old Income Tax regime and has made tax investments, this information is also available in Form 16. This form is like a master document for you.

‘Deadline’ for issuance of Form 16

As per the Income Tax rules, employers (companies) must pay TDS for January-March to the Income Tax Department by March 31.

Companies will have to file e-TDS returns for this. Form 16 has to be issued within 15 days of filing them. This means that Form 16 should be issued to the employees by June 15. This year too, companies are expected to issue Form 16 to their employees by June 15.

Even though CBDT has extended the last date for filing income tax returns to September 15, companies have to issue Form 16 by June 15. This ensures that the right information is available to employees on time.