The Income Tax Department has launched digital Form 16 for the convenience of taxpayers. This move comes after the recent update of ITR Form 1 to 7, which will make filing returns even easier. Form 16 already includes salary, tax deduction (TDS) and other details, but the digital format makes it much more effective. This fantastic initiative is a great relief for taxpayers and an important milestone towards Digital India.

What is Form 16

Form 16 or 16A is a certificate issued by the employer when it deducts tax from the salary of the employees. It contains information about how much tax was deducted and deposited to the government. This document is given to the employees by the end of May every year. It is an important proof for taxpayers.

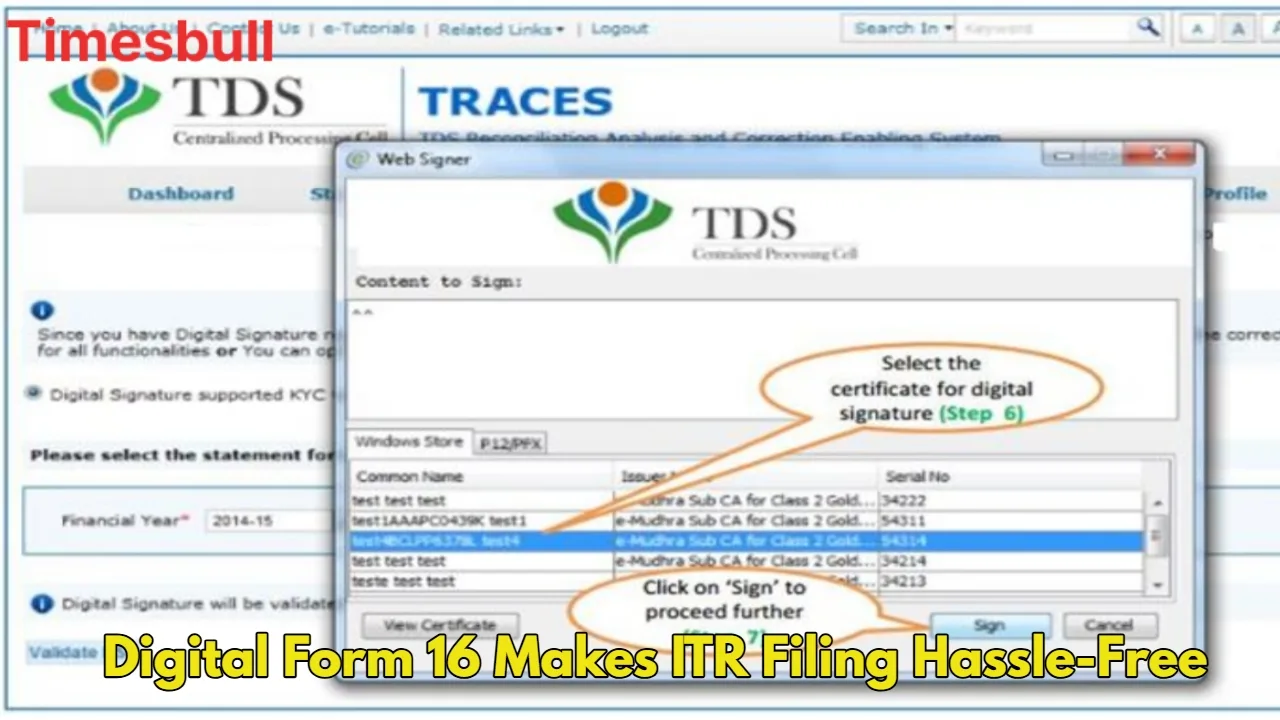

How does digital Form 16 work

Digital Form 16 is generated directly from the TRACES portal, so the information given in it is completely accurate and consistent. This new digital form contains complete details of tax-free exemptions, deductions, and salary, which prevents any misunderstanding while filing taxes.

Now taxpayers can directly upload this digital document to the tax filing websites. The system automatically fills in all the necessary information, which saves time and reduces the chances of mistakes. Also, if any mistake is made, the system gives an alert so that it can be corrected beforehand. This digital Form 16 makes tax filing extremely simple and efficient.

Which ITR form is for what

There are two simple forms for simple taxpayers :

ITR-1 (Sahaj): This can be filed by people whose annual income is up to ₹50 lakh. This includes people who earn money from salary, income from one house, interest, and agricultural income up to a maximum of ₹5,000.

ITR-4 (Sugam): This is for individuals such as HUFs (Hindu Undivided Families) or Hindu Undivided Families (HUFs) and firms whose income is less than ₹50 lakh and they earn from business or profession.

Last date for filing returns

For individuals who do not want their returns audited, the last date for filing returns is July 31. For businesses and professions who want their returns audited, the deadline is October 31. With digital Form 16, filing returns has become easier, faster and safer than ever. So, file your returns before your last date and avoid any penalty.