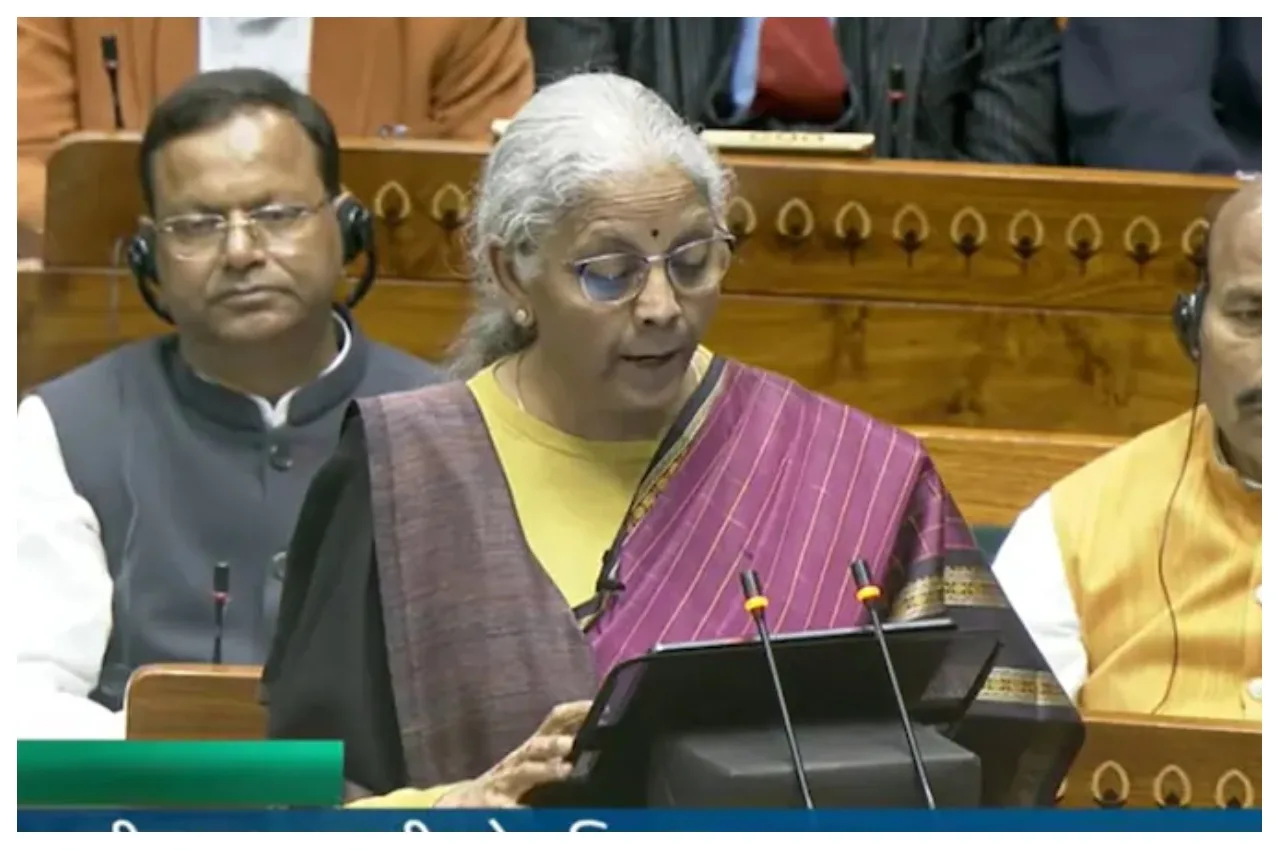

Union Budget 2026 Updates: Today, February 1st, Finance Minister Nirmala Sitharaman is presenting the 9th Union Budget in Parliament. Parliamentary proceedings have begun. Finance Minister Nirmala Sitharaman has started her budget speech. She is presenting the budget for the ninth consecutive time today, February 1, 2026. Finance Minister Nirmala Sitharaman began her budget presentation by invoking the name of Sant Ravidas. During her budget speech, Minister Nirmala Sitharaman said that they want to promote entrepreneurs like champions. They are allocating ₹10,000 crore for this purpose, so that entrepreneurs can benefit.

The Finance Minister also stated that their focus will be on the biopharma sector. They are allocating ₹10,000 crore for this. The Finance Minister said that the India Semiconductor Mission 1.0 has expanded the country’s semiconductor capabilities. Finance Minister Nirmala Sitharaman announced that cancer and diabetes medicines will become cheaper across the country. Minister Nirmala Sitharaman announced the establishment of 3 new All India Institutes of Medical Sciences (AIIMS). Furthermore, Finance Minister Nirmala Sitharaman said that girls’ hostels will be built in every district for higher education institutions.

Major announcement regarding Income Tax:

Finance Minister Nirmala Sitharaman announced ₹2000 crore for Atmanirbhar Bharat (Self-Reliant India). In addition, the income tax forms will be simplified. The new law will be implemented from April 1, 2026. Revised ITRs can be filed until March 31st. This law proposes to change technical errors from penalties to fines. Furthermore, only fines will be levied for minor tax offences. Taxes on foreign travel will be reduced. The TCS rate for foreign travel has been reduced to 5 per cent. Returns can be filed until July 31st.

The Finance Minister introduced a 6-month scheme for taxpayers to disclose their foreign assets. Additionally, the last date for filing ITR-1 and ITR-2 has been set as July 31st. The TCS applicable to the health and education sectors has been reduced from 5% to 2%. Furthermore, the TDS rate on foreign travel has been reduced to 2 per cent. The Finance Minister announced a comprehensive review of the Income Tax Act, 1961. This process was completed in record time, and the Income Tax Act, 2025, will come into effect from April 2026.

Two important decisions aimed at providing relief to the common man were made in this budget. The government has reduced the TCS (Tax Collected at Source) rate on overseas tour packages from the 5-20 per cent range to a flat 2 per cent. Additionally, the TDS (Tax Deducted at Source) on remittances sent under the Liberalised Remittance Scheme (LRS) for educational purposes has also been reduced. This decision will provide significant relief to students studying abroad and their families.

Government Expenditure:

Rs. 26.7 lakh crore in taxes. Total expenditure is Rs. 49.6 lakh crore. Capital expenditure stood at Rs. 11 lakh crore. The loan deficit is estimated at Rs. 36.5 lakh crore for 2026-27. An expenditure of Rs. 53.5 lakh crore has been announced.

Buddhist Circuit to be developed in the Northeast

Finance Minister Nirmala Sitharaman announced that a Buddhist Circuit will be developed in the northeastern states. This circuit will cover Arunachal Pradesh, Sikkim, Assam, Manipur, Mizoram, and Tripura.