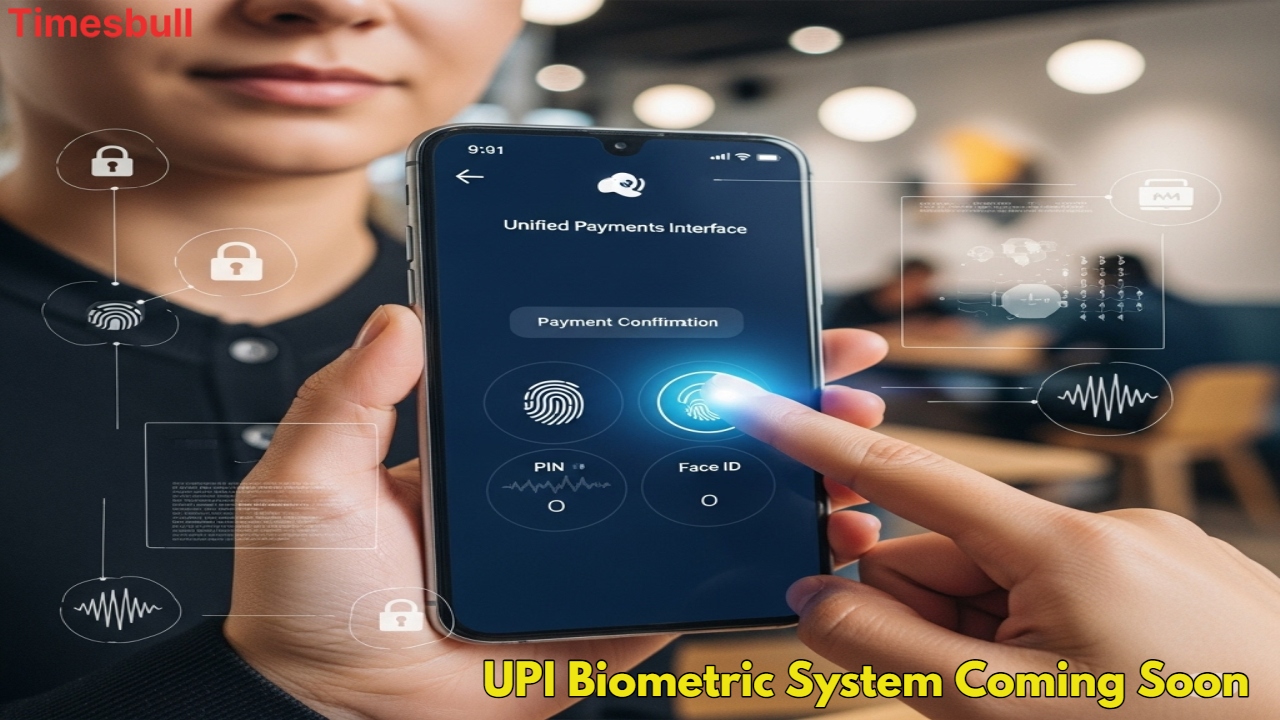

Making payments through UPI is going to be even easier now. Are you also tired of entering your UPI PIN every time? Then there is good news for you. Soon you will be able to make payments using only fingerprint or face ID. Yes, NPCI is preparing to bring a new system that will make transactions even more secure and faster. Know what is this biometric payment system and by when this special facility can be available.

Fingerprint and Face ID will be used instead of PIN

In today’s time, UPI payment has become an important part of our lives. But, entering PIN every time seems like a hassle for many people. To overcome this problem, the National Payments Corporation of India (NPCI) is preparing to bring a revolutionary change – the Biometric Payment System. This new facility will not only make transactions more secure than before, but will also make them much easier. But the question is, what is this biometric payment system, and when can this facility start? Let’s know in detail.

What is a biometric payment system, and how will it work

In the biometric payment system, fingerprint or face ID will be used to confirm the payment. This payment facility is much more secure and easier to use than a PIN or password. PIN or password can be easily stolen or copied, but it is almost impossible to copy biometric data such as fingerprint or face recognition.

This system will work in the same way as you use fingerprint or face ID to unlock your phone. You just have to scan your finger or show your face in front of the camera, and the payment will be done. This will also reduce the time taken in the payment process.

When can this facility start

So far, NPCI has not given any information about the launch date of this new payment facility. However, they have made it clear that their entire focus is on making UPI payments more secure and easy. It is quite likely that in the coming days, there may be a facility to use biometrics instead of PIN in UPI.

Big changes are happening in UPI from August 1

Some more big changes are going to be implemented in UPI from August 1. These changes include balance check limit, autopay time, payment reversal limit, payment status viewing limit, and transaction history viewing limit. According to the new rules, autopay requests can now be sent only before 10 am and between 1 pm and 5 pm. Now users will not be able to check their bank balance more than 50 times in a day. These changes have been made by NPCI to make the UPI system more efficient and secure.