LIC’s Jeevan Anand: People invest in different places according to their convenience and need – some in the stock market, some in mutual funds, and some elsewhere. If you are also looking for a safe and profitable investment, then a special scheme of LIC can be very useful for you. This scheme gives you a fantastic opportunity to collect funds worth lakhs of rupees by depositing just ₹200 daily. Let’s know everything about LIC’s ‘Jeevan Anand Policy’.

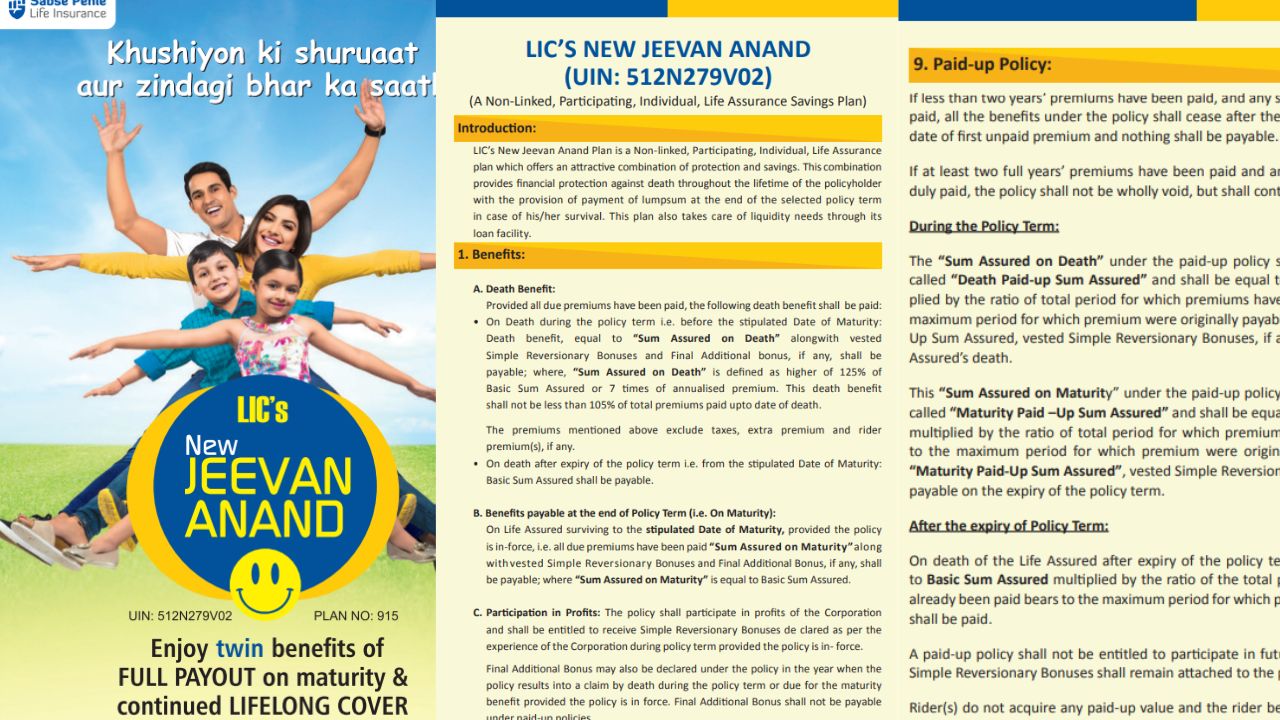

LIC’s Jeevan Anand Policy

Let us tell you that LIC’s ‘Jeevan Anand Policy’ can be a very good policy from an investment point of view. In this, if you deposit a premium of ₹200 daily for 30 years, you can collect a fund of about ₹30 lakhs. This is an excellent example of long-term savings and wealth creation.

Term Maturity Plan

This policy of LIC is a ‘term maturity plan’. If you have taken a plan for 30 years, then you have to pay a premium for 30 years. If the policyholder dies in the meantime, then 125% of the basic sum assured or 125 times the amount of premium deposited till death is given to the nominee. It provides a strong shield of financial security for your family in case of an emergency.

Benefits and Eligibility of Bonus

You also get a bonus on your deposit amount in this scheme. Anyone from 18 years to 50 years old can take this policy. In the policy, you can choose a plan from 15 years to 35 years. You can make monthly, quarterly, half-yearly, and yearly payments too. It provides flexible payment options.

Loan facility and more information

You also get a loan facility on this scheme. To get more information about this Jeevan Anand policy of LIC, you can visit your nearest LIC branch. You can apply for this scheme from there too! It will pave the way for you to financial freedom.