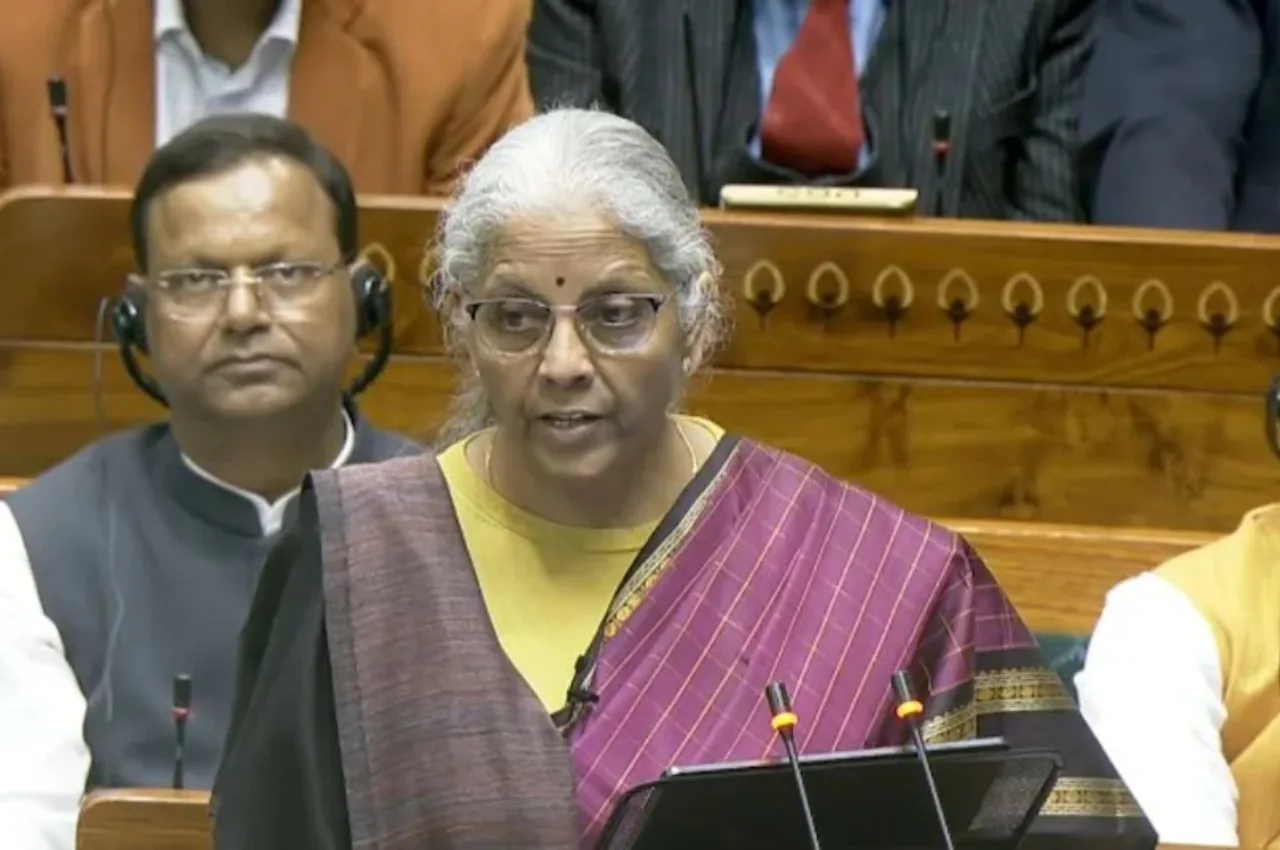

Budget 2026 Hits and Misses: Union Finance Minister Nirmala Sitharaman presented her ninth consecutive budget in Parliament today, February 1, 2026. As soon as the budget speech ended, every Indian had only one question on their lips: “What has become cheaper for me, and what has increased in price?”

In this budget, the government has taken several major decisions with “Make in India” and public health in mind. While reducing the prices of cancer and diabetes medicines has provided significant relief to millions of patients, tobacco users and alcohol consumers have been burdened.

Medicines for serious illnesses have become cheaper

The health sector has been given top priority in Budget 2026. Adopting a humanitarian approach, the government has significantly reduced the duty on life-saving drugs used to treat life-threatening diseases like cancer and diabetes. Following this revolutionary decision, treatment for these diseases will become significantly more affordable.

The Finance Minister believes that lowering drug prices will strengthen the country’s health infrastructure and ensure timely treatment for even the poorest of the poor. This move has come as a significant relief to middle-class families, whose vast majority previously went toward medical expenses alone.

Smartphones Will Become Cheaper

If you’ve been considering purchasing a new phone or tablet, this is the perfect time. To take the “Make in India” campaign to new heights, the government has provided significant relief on components used in smartphones and tablets manufactured in the country. This will boost domestic manufacturing and reduce production costs for companies.

It is expected that the prices of mobile handsets from renowned companies will decline in the coming days. This decision will not only connect youth with modern technology but will also create new employment opportunities in the country.

Sports Goods and Leather Products

To encourage youth and athletes, the Finance Minister has made a significant announcement to reduce the prices of sports equipment such as cricket, football, and badminton. The reduced prices of sports equipment will provide opportunities for talent in rural areas to thrive.

Furthermore, the leather industry has received a significant boost in the budget. Leather shoes, wallets, and bags will now be available at much more affordable prices. This will increase demand in the footwear sector and make it easier for the middle class to purchase branded goods.

Tobacco and Alcohol

In this budget, the government has further tightened its Sin Tax policy. Alcohol lovers will now have to spend more than ever on their favorite drinks due to the increase in excise duty. Additionally, taxes on cigarettes and other tobacco products have been significantly increased.

According to the new rules, additional cess and per-stick fees will be levied on top of the 40% GST. The government’s objective is clear – to wean people away from drug addiction by keeping high prices and also to increase revenue.