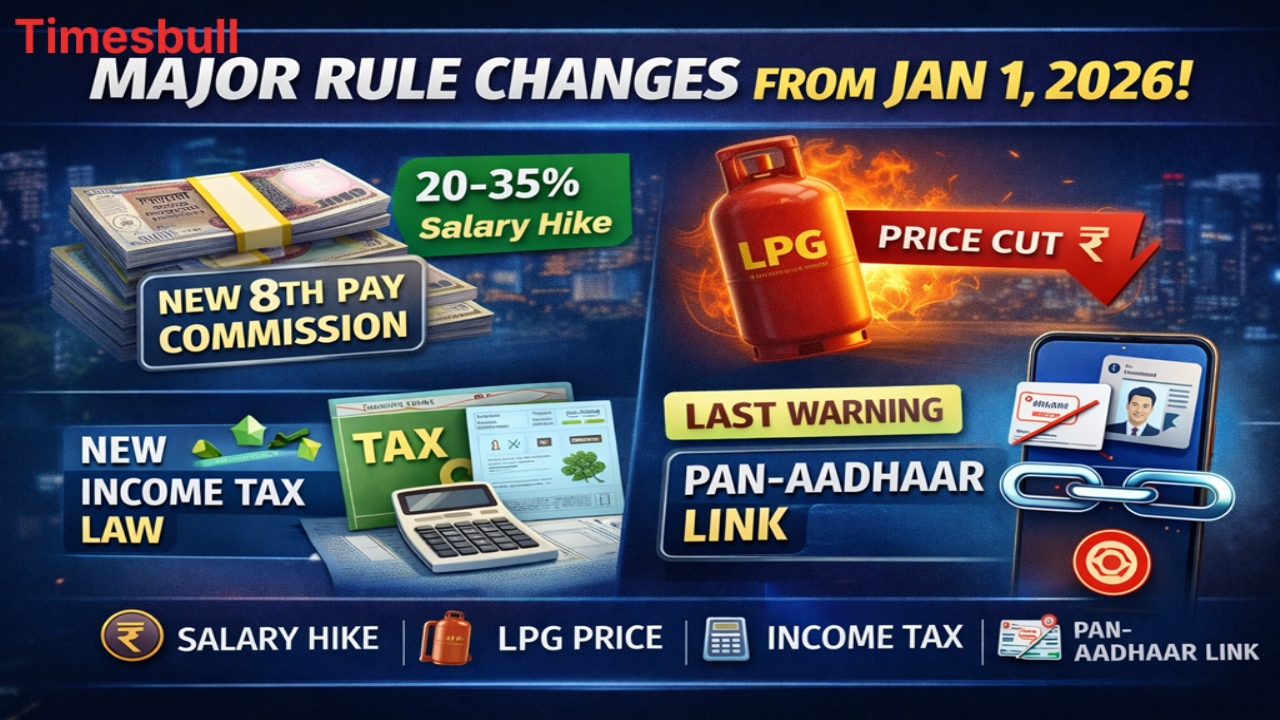

The new year 2026 brings significant changes to the lives of the common man. From January 1, 2026, the salaries of government employees across the country, domestic gas prices, and many important rules related to income tax will change completely. While the implementation of the 8th Pay Commission is expected to bring significant increases to employees’ pockets, the new online system of PAN-Aadhaar linking and ration cards will also impact your daily routine. This article analyzes all the major changes that will have a direct and significant impact on your savings, investments, and expenses.

8th Pay Commission

The year 2026 brings significant changes for over 10 million central government employees and pensioners, as the 8th Pay Commission is expected to be officially implemented on January 1, 2026. According to experts, based on the new fitment factor, employees’ basic salaries could see a substantial increase of 20% to 35%, and retired employees’ pensions will also increase proportionately, significantly strengthening their financial position. Additionally, HRA and dearness allowance (DA) will also be reset in accordance with the new pay structure.

Relief in LPG, CNG, and PNG prices

The start of the new year could bring significant relief to kitchen budgets, as petroleum companies review prices on the first of every month. Given international market trends, there is a strong possibility of a substantial reduction in domestic gas cylinder prices.

Additionally, under the government’s “One Nation, One Grid, One Tariff” policy, major changes are being made to gas pipeline transportation charges, which could lead to a dramatic drop in CNG prices by ₹1.25 to ₹2.50 per kg and PNG prices by ₹0.90 to ₹1.80 per SCM. This change is a major relief for families who use pipeline gas for daily cooking.

New Income Tax Bill and Ration Cards

The year 2026 brings significant reforms for taxpayers, as the government has passed a new Income Tax Bill that further simplifies tax slabs. GST rates on several everyday items have also been reduced, reducing the burden on consumers. Ration card services are also undergoing revolutionary changes, with the entire process, from obtaining a new card to correcting a name, now 100% online. This is a significant relief for people living in rural and remote areas, as they no longer need to run around government offices.

PAN-Aadhaar Linking and Banking

If you haven’t linked your PAN card to Aadhaar by December 31, 2025, your PAN card will become inoperative from January 1, 2026. This is a stark warning, as you will no longer be able to perform banking transactions, apply for loans, or file income tax returns. The banking sector will also see major changes, as your credit score will now be updated weekly instead of every 15 days. Major banks like SBI, PNB, and HDFC have revised their fixed deposit and loan interest rates, effective from the first of the new year.

New EPFO Rules

The EPFO has simplified the PF withdrawal rules for employees. By eliminating the old complex rules, withdrawals have been divided into three main sections, making withdrawals for medical, marriage, and unemployment easier. This new system aims to provide immediate financial assistance to employees in times of urgent need while protecting retirement savings. Employees will now be able to track their withdrawal process through a mobile app.