Vivo Takes the Throne: India’s smartphone market was amid vigorous momentum in the year 2024, as it recorded a 5% year-over-year growth and exported a total of 128 million units, stated the latest report by IDC. Out of all the brands, Vivo dominated them all, topping the list to become the largest-selling smartphone brand in the country with a tremendous 14.1% growth. It’s a remarkable transformation in the game of India’s smartphone market competitive landscape where business houses fight tooth and nail for price-sensitive buyers.

Read More: iPhone 16 Pro vs iPhone 15 Pro: What’s New in 2025?

Read More: Samsung Galaxy S25 vs Samsung Galaxy S24: Worth the Upgrade?

Vivo Surpasses, Samsung Falls

Vivo surpassed competitors like Samsung, Xiaomi, OPPO, and Realme to become the number 1 smartphone shipment brand. While Vivo increased steadily in all regions of India, Samsung could only dominate South India with a 15.9% market share. Samsung’s overall performance fell with a 7% decline in sales. On the other hand, Xiaomi and OPPO showed good growth by 2.4% and 13.4%, while Realme experienced a sharp decline in sales with 10.9%.

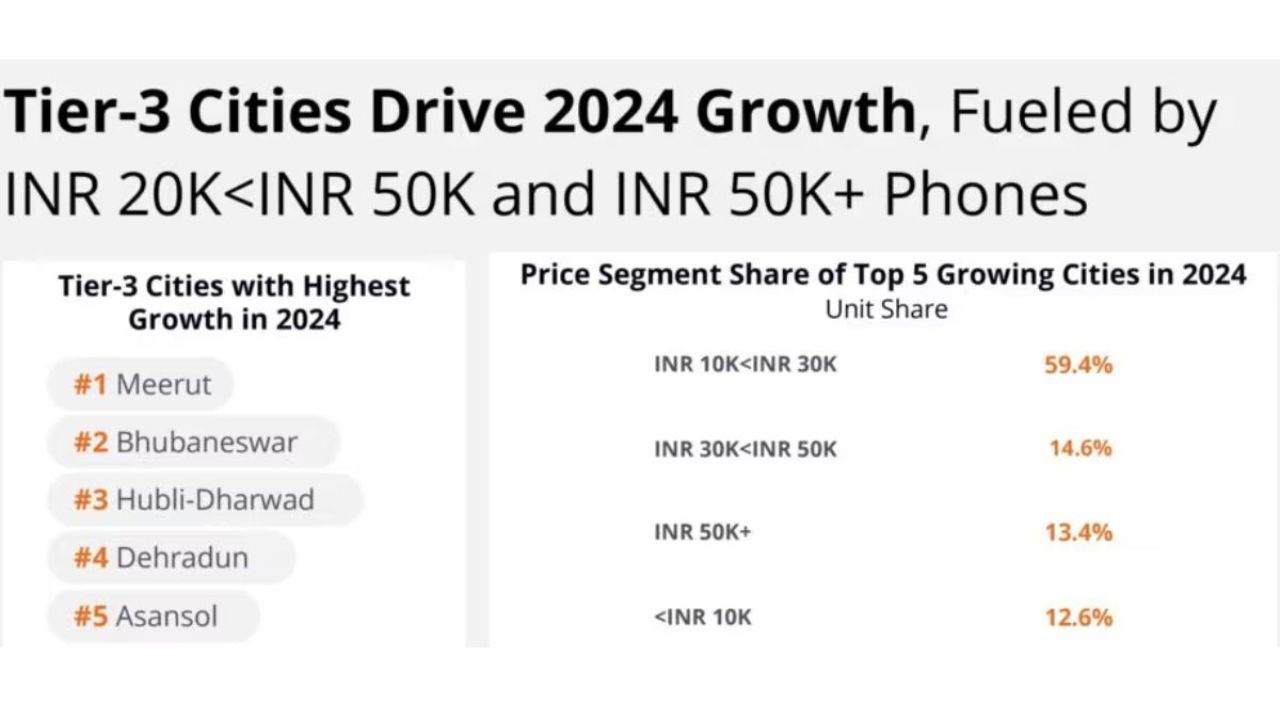

Tier-3 Cities Record Sustained Growth

One of the best things about 2024 was the strong growth in smartphone sales from Tier-3 cities. Cities like Meerut, Bhubaneswar, and Hubli-Dharwad witnessed highest growth among emerging urban markets. In these clusters, the smartphones between ₹10,000 and ₹30,000 ruled the sales, with 59.4% of the share. Such growth reflects the rising demand for value-for-money-packed smartphones in the smaller towns.

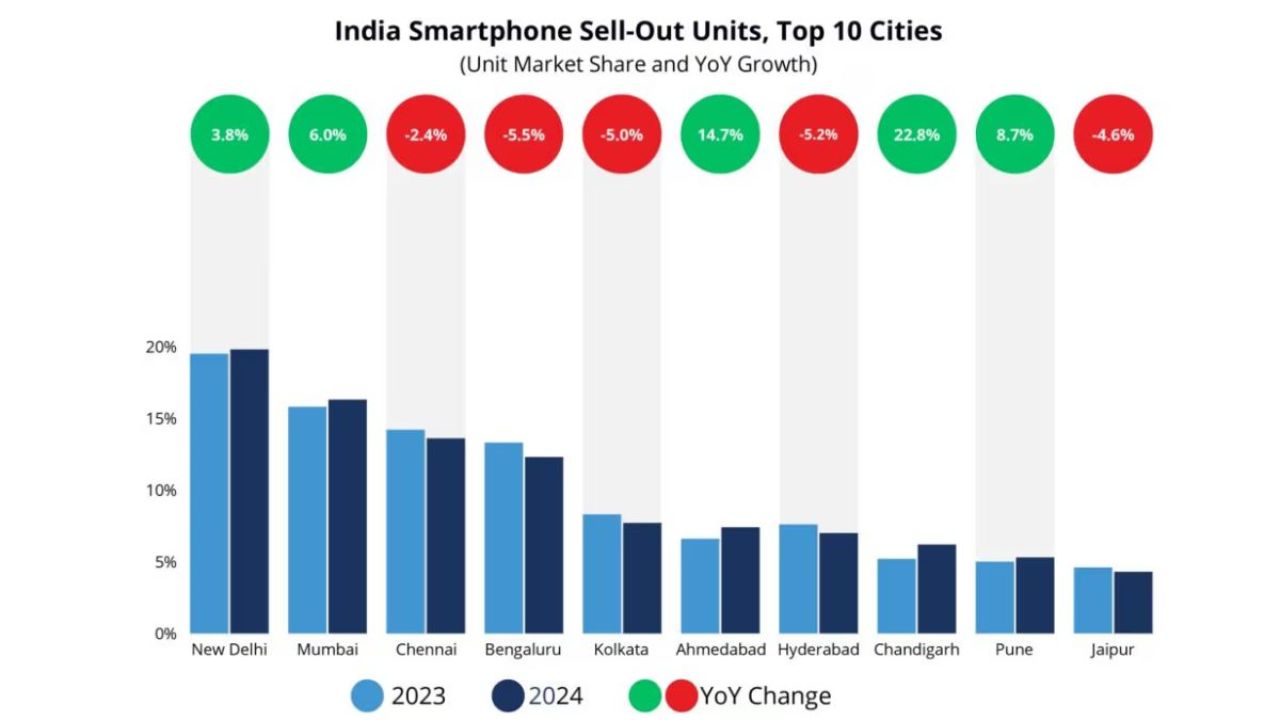

Top Cities and Evolving Market Trends

Metro cities such as Delhi, Mumbai, and Chennai continued to be the top three markets in terms of overall sales. However, all three of them declined marginally from last year 3.8% in Delhi, 6% in Mumbai, and 2.4% in Chennai. The surprise was Chandigarh’s growth rate, clocking a whopping 22.8%, showing that Tier-2 towns, too, are turning out to be important markets for smartphone vendors.

What Was the Best Price Segment?

The ₹10,000 to ₹30,000 segment grew the most in 2024, accounting for 50% of all sales of smartphones. Out of this segment, smartphones between ₹10,000 to ₹20,000 accounted for the highest volume. Conversely, phones priced higher than ₹50,000 accounted for 20% of total sales. Significantly, the highest growth emerged in the ₹20,000 to ₹50,000 segment, reflecting a rising demand for mid-premium phones with superior features and performance.

Whereas Tier-3 cities grow and more and more users migrate towards mid-segment phones, the smartphone segment of India is absolutely changing, and Vivo is spearheading this change by staying ahead in the curve as far as pricing and innovation go.